At a time when the French are paying more attention to their consumption, the Retail sector must reinvent itself to continue to attract customers who are increasingly reluctant to push the doors and shopping carts of hypermarkets. Indeed, the turnover of supermarkets has only increased by 0.3% over the last three years. This is ten times slower than the entire market including GMS, Drive, e-commerce and Hard Discount. This observation benefits specialised stores, local primeur chains (La Compagnie fermière, CAP Primeur) and local merchants benefiting from a real renewed interest.

Drive, digitization, organic conversion, vegetalization… how do supermarkets adapt to new paradigms dictated by buyers?

-

The shopper eager for new experiences

No more Saturday afternoons strolling around the aisles of huge hypermarkets, customers (= shoppers) are looking for a shopping experience:

- « I’m not just going to do my food shopping”: the « corner » Cdiscount invite themselves into the hypers Géant Casino while Carrefour conducts implementation tests with Darty. The brands choose omnichannelity by offering tasting workshops and optimising vacant spaces with areas dedicated to the reception/storage of parcels. This is called « new retail ». A concept that is gaining momentum in France and abroad.

- « I need proximity, speed and clarity in the offer« : urban mini-markets are exploding (+20% between 2016 and 2017) and offer

schedules that are more adapted to the lifestyles of new workers. Franprix launches the night opening when the Ximiti franchise positions itself on 100% automated 24/7 connected proximity. In supermarkets, digital is essential and facilitates the purchasing process. Bollards, scanners and automatic cash registers give a playful and practical dimension while pushing incognito to consumption. The food area is more highly valued with increasingly imposing bulk grocery stands and « market » self-service.

It is therefore in the best interest of the brands to stand out by offering an experience that enables them to activate all the shopper levers to restore a dynamic of frequentation and purchasing to the mass retail sector.

-

Towards responsible consumption

Armed with their smartphone applications, consumers are now real consum’actors. They are committed to promoting the short circuit, organic food, animal welfare… In this sense, the communication strategy is now intended to be bottom-up. To seduce and reassure, it is necessary to go up the chain (cultivation, breeding, processing) and less talk about the finished product. Some concrete examples:

- Agriculture: Intermarché and many others follow the steps imposed by C’est qui le patron. Giving and giving initiatives that restore the image of the brands while enhancing farmers’ remuneration.

- Animal welfare: Casino has partnered with NGOs to develop a label evaluating animal welfare using 230 criteria. We can also mention the start-up PouleHouse and its partnership Monoprix x La Fabrique à Cookies (#jesauvelapoule).

- The farm is invited to supermarkets: Agricool, Farmbox are projects with ecological ambitions that allow urban culture within recycled containers. No GMOs or pesticides, a carbon footprint close to zero and products with a nutritional quality equivalent to or even superior to those found in supermarkets: these farms of tomorrow have everything to please. Despite low volumes, the business model guarantees fixed prices and comfortable margins all year round.

- Blockchain

- Organic diversification, veggie, vegan: to keep up with flexitarian, organic and vegan trends, the distribution ranges are diversifying. It has become an impossible mission not to find products carrying the green leaf within the various food circuits. From hyper to proximity to Hard discount, 46% of organic products were sold in supermarkets in 2018. The regulation requires a minimum of 3 years of conversion before a product can be marketed under the organic name. Leclerc has therefore rushed into the breach of this intermediate market by proposing a « Harvesting the Future » label supported by its own brand. This label supports producers in their conversion. In the first year they are marketed conventionally via the Repère brand before benefiting from the « Harvesting the Future » in the second year and then definitively integrating the private label BioVillage in the third year. A wise choice that allows the « cheapest » distributor to drive prices down while making organic food accessible to as many people as possible.

There is no denying it: vegetable protein dishes are taking up more and more space on the shelves to the detriment of industrial dishesand meat. The biggest brands give the « la ». Nestlé would be in the process of selling its Knacki sausage business to « more profitable » and profitable products.

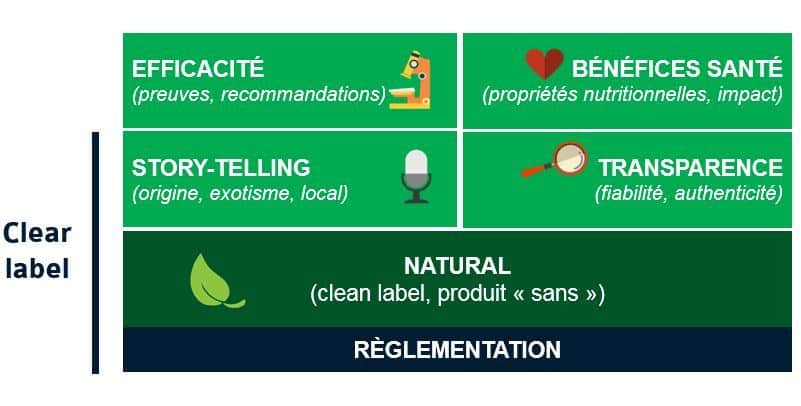

- The clear label, a new priority for consumers: getting information on the origin and composition of products has become commonplace on food shelves. For several years now, the need to believe in the values conveyed by the brand (transparency, ethics, reliability, etc.) has nourished customer trust and loyalty. These new reasons for believing are additional arguments for food-industries to affirm their commitment to a clearer (e. clear, net) and more efficient food supply.

Initiatives are multiplying at the point of purchase. Among them, the « National pact on plastic packaging for 2025 » – signed by Auchan, Danone or L’Oréal – aims to reduce bulk packaging, promote recycling, replace plastic with cardboard, or even eliminate straws. Other initiatives such as Carrefour’s Act For Food involve a more global challenge throughout the production chain: from the fork to the fork (or even to the bin!), all the links in the chain are optimized.

- But the responsibility also lies in the prices charged: lost between yellow labels, exceptional gratuities and increasingly imposing and theatrical highlights, it is difficult for the shopper to understand the real issues of promotion. The buying process today has nothing to do with that of a few years ago. We are looking for lower prices, but not at the expense of product quality.

The Egalim law adopted in October 2018 favours a reconsideration of the work of farmers and the tightening of promotional conditions. However, it seems that the pill is having trouble getting through to the distributors. The end of February 2019 marked the end of negotiations with suppliers, and therefore the implementation of the limitation to a maximum promotion of 34% (25% by volume). While the results seem to be good for the dairy sector, meat and fruits&vegetables products still suffer from an underconsideration and overconcentration of the number of producers pulling the negotiations down. It is difficult to know if the revenues generated as a result of the lowering of the resale at a loss threshold go back into the pockets of the right intermediaries….

Despite the brands’ efforts to rekindle the flame with their customers, it has to be said that physical places of purchase are less and less popular.

-

The brands are dematerializing

E-commerce now accounts for 5.6% of the cake share of consumer goods. A figure that is expected to double by 2025! In an era where speed and efficiency are the watchwords, it is difficult to fight the invisible enemy represented by algorithms that can now predict your shopping list based on your tastes and previous purchases. Speech recognition of GAFAs (Amazon, Google, Apple) will further simplify the purchase and slow down the visit of supermarkets.

It is in this dynamic of ultra-simplification of the purchasing act that pedestrian drives flourish in French cities. Thanks to the increase in sales made on the « vehicle » drive circuit (+8.2% according to the IRI report of November 2018), these urban concepts mark a small revolution that could boost mass distribution.

Futuristic projects are also under consideration: Loop, an American platform for purchasing unpackaged food products, or Amazon and its delivery of shopping by drone should see the light of day.

It will be interesting to monitor the evolution of performance in mass distribution and to quickly draw the consequences to adapt to the growing expectations of French consumers. Merger of purchasing groups, partnerships, acquisition and disposal of activities, start-up incubators are all indicators that will make it possible to measure the direction that will be taken by the agri-food giants and the future of supermarkets.