Breakfast cereals are the symbol of modern breakfast. We thought they would be comfortable in our bowls, but young brands have decided otherwise by offering a healthier and more natural offer. How did the historical leaders react? Do they still have a chance to be credible on nutrition and health issues? A look back at a turbulent journey.

Breakfast cereals: from the revolution of our meals to the demonization of sugar

Imported into Europe from the United States by Kellogg’s, breakfast cereals have a long way to go! They have accompanied the modernization of our societies and the change in our pace of life, with less time spent at the table and in the kitchen. They seemed to be the miracle solution to keep having a good breakfast despite the lack of time. But gradually, their image deteriorated:

- In the 70s and 90s: the « honeymoon », with the typical image of a balanced breakfast based on cereals and milk.

- 2000-10: the debacle, with attacks on their sugar, salt, fat content, and repeated publications in the media around « Should we stop eating breakfast cereals? »

- 2010-20: renewal, with the pressure of very innovative start-ups on the nutrition-health-ESR component.

Thus, in 2017, the breakfast cereal market was growing, but growth was relatively modest: +0.6% according to Iri, in a market that represented just over €700 million at the time.

Kellogg’s, Nestlé… and if their cereals were no longer credible in the field of nutrition?

Nutrition has long been a key communication tool for cereal manufacturers. According to a study conducted by Credoc with cereal consumers, they would better manage their weight and have better vitamin and mineral intakes.

But the lack of effort on the nutritional composition of most ranges (too much sugar, salt and fat vs. not enough fibre, whole grains and not enough satiating) has severely damaged their reputation. Indeed, without reviewing their recipes, the historical leaders first reoriented their communication towards the convenience and pleasure of children. It is true that cereals appear to be the best way to make the most recalcitrant people eat breakfast. Since 2010, Kellogg’s has signed its « Les Matins Réussis® » communications or how to avoid the diplomatic crisis at home. But now we realize that this was not enough and that others took the opportunity to pre-empt the subject of nutrition.

Historic giants pushed by newbies: the Kellogg’s case

Listed on the stock exchange for $18.9 bn as of July 1, 2017 and with sales of ~€532 million in France the same year, Kellogg’s is the historical leader. The American giant represents 40% of the market share in France according to LSA. However, by 2013, he had to set up Project K, which consists of saving no less than $475 million a year. Proof that leaders are not unshakeable.

So who are these new kids who knocked over the table? They don’t really have a face because they are numerous: ThePaleoFoods’ paleo granola, Dear Muesli’s custom muesli delivered at home, Foodspring’s protein mueslis and porridges…

Find more examples in our 2020 nutrition-health trends booklet.

However, they all have one thing in common: nutrition-health-naturality as a motivation. Thus, as often happens, innovation did not come from the « top » but rather from the « little ones ». Little ones who may be redeemed in the near future by the big ones….

In this context, Kellogg’s is taking two major actions:

- On the one hand, the tightening of these historical activities. The American is looking for buyers for brands such as Keebler (cookies) or Famous Amos (cookie baking), to focus on breakfast and snack products. While Kellogg’s in Europe is best known for brands such as Special K or Coco Pops, it is other brands that generate the bulk of the giant’s sales, such as Eggo (waffles) or Froot Loops.

- On the other hand, nutritional improvement. Since 2010, most recipes have been revised for less simple sugars (-6%) and salt (-8%), and more fibre (+9%) and whole grains (+33%). As well as numerous product launches.

Breakfast cereals and their new nutrition-health face

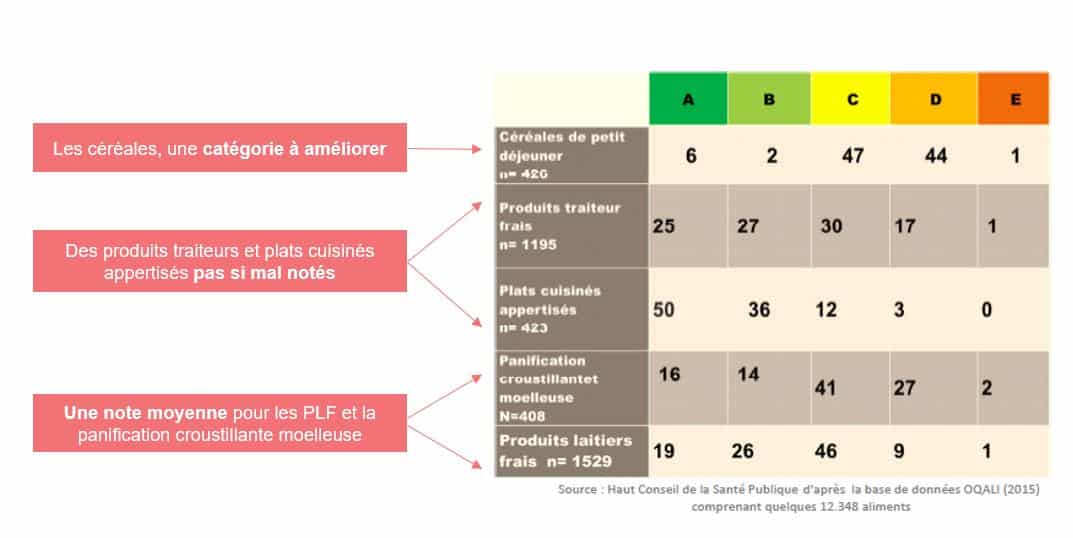

To date, the Nutri-Score of breakfast cereals is on average C or D. But the pressure exerted by start-ups has committed the leaders to an innovation approach, and this for several cereal categories. This profile should therefore improve.

Cereals for children with less sugar

Chocolate cereals represent the most sold category in France, followed by muesli (source Iri March 2017). Very often, these chocolate cereals are consumed by our children, a population sensitive enough to be able to improve their nutrition.

Jordans recently launched Funny Crisp: its first line for children. With its natural image, Jordans aims to offer parents the perfect combination: nutrition-health-practicality.

https://www.facebook.com/CerealesJordans/videos/573087806456148/

Coco Pops, a product that children love, saw its simple sugar content decrease by 43% between 2017 and 2018. Today, Kellogg’s can claim « 30% less sugar than chocolate cereals for children on the market ».

Organic cereals

Among the controversies around breakfast cereals, there were (also) those about pesticide residues. Most of the major brands now have their organic reference and can reassure about this. Although the organic segment represents « only » 10% of sales in France, it grew by +41% in value in 2017 according to Iri.

Functional cereals

If the historical leaders have been slow to react, it would seem that their passivity is history. Kellogg’s, for example, recently launched

Happy Inside, an on-the-go breakfast that provides fibre, probiotics and prebiotics. This new range, which can be called HI! is deliberately positioned on digestive health (in the US, 70 million Americans suffer from digestive disorders[1]). On the occasion of this launch, Kellogg’s conducted a study on the awareness of pro and prebiotics among Americans. As a result, 29% are familiar with probiotics and 15% with prebiotics[2]. Hence the interest of coupling them within the same finished product to make pedagogy.

The dynamics observed in the breakfast cereal market is a typical example of the power that consumers have to change things. The food industry is certainly a big machine, but a relatively flexible big machine!

1] US Department of Health and Human Services National Institute of Diabetes and Digestive and Kidney Diseases, 2010

[2] by The Harris Poll among over 2,000 US adults